Introduction

In the world of mobile apps and gaming, one metric stands out when it comes to financial success: Average Revenue Per User (ARPU). While ARPU can vary greatly across different regions, one country that consistently outshines the rest is Japan. Japanese users demonstrate a remarkable willingness to pay more for in-app purchases and mobile games, leading to significantly higher in both ARPU and ARPPU figures. In this article, we delve into the reasons behind Japan’s exceptional figures and explore the unique factors that contribute to its success.

Contents

Japan Gaming Industry and its Top Figures

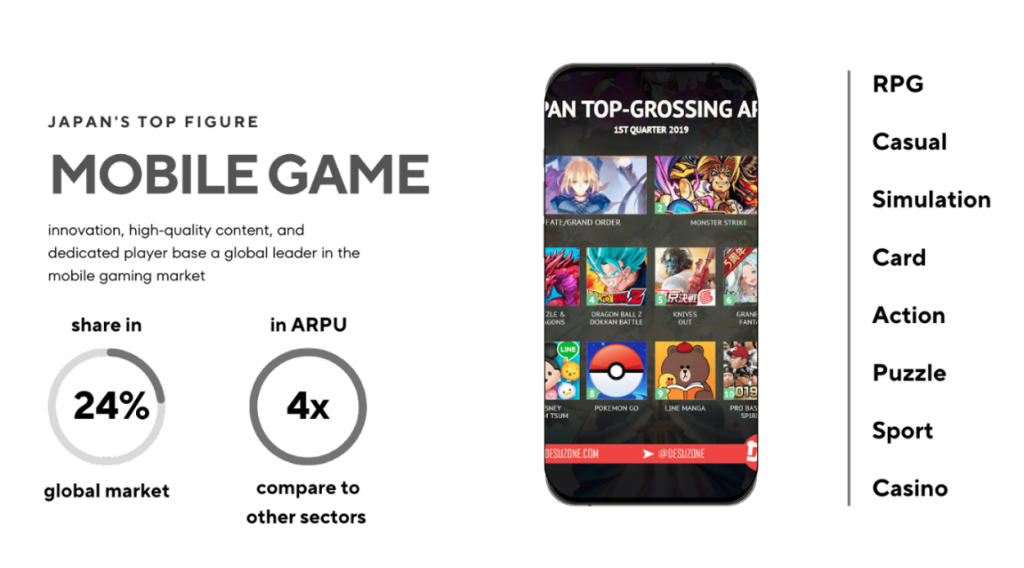

The mobile gaming industry in Japan is not only vibrant but also financially lucrative. According to industry reports, Japan consistently ranks among the top countries in terms of mobile game revenue.. In 2021, the mobile gaming market in Japan generated an impressive revenue of over $22 billion, cementing its position as the second-largest player in the global market with a share of 24%(Global Data).

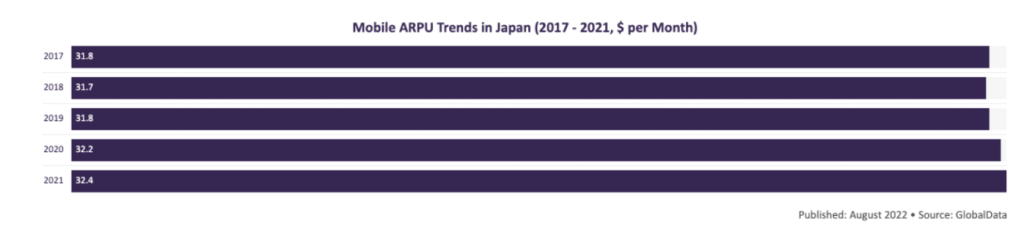

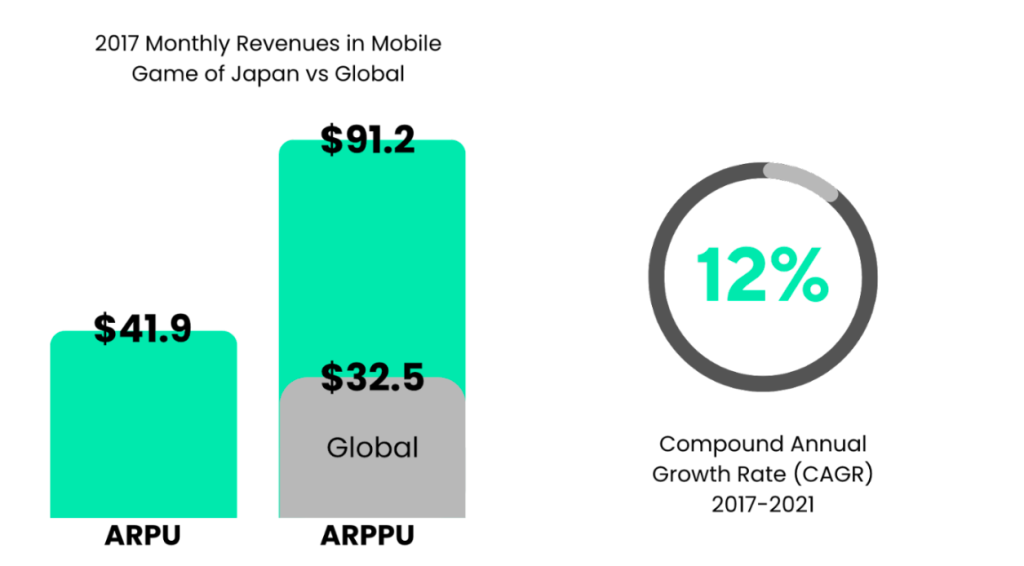

In 2021, Japan placed third globally in terms of ARPU trend, according to Global Data. As of 2022, the ARPU in Japan’s mobile games segment is projected to be $418.99, which is significantly higher than the worldwide ARPU in the mobile games segment, according to a report by IRep. While the revenue per user is continuously rising in all segments, the mobile games part achieves the highest ARPU, proving the emerging development of the mobile gaming industry in Japan.

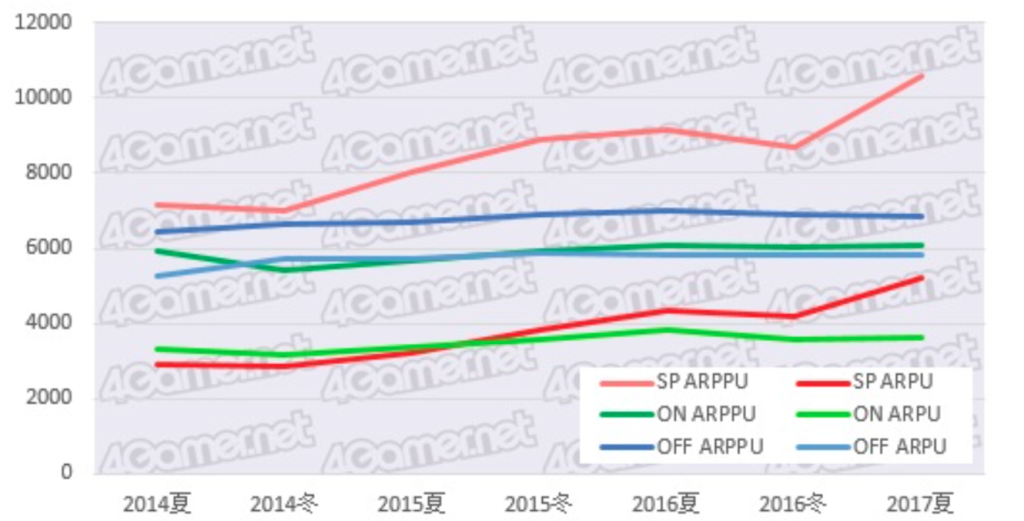

While there are not many disclosures about the recent growth of ARPPU in Japan’s mobile gaming market, there was a rare study on this figure in 2017. Published at 4Gamer, this article provided a comprehensive look into the gaming industry at that time.

By the time of summer 2017, the monthly ARPU reached ¥5,035 for smartphone games (with the highest amount of ¥50,000). While over 40% of players do not spend in games, the rest, whose revenue is considered as ARPPU, spent around ¥10,204 per month in mobile games. This amount was reported to be spent within 2 games by 80% of the respondents, which means mostly paid-users in Japan tend to spend a lot of money on just one or two of their favorite games.

Further growth of ARPU in ARPPU in Japan Mobile Game market before 2017 can be observed in the graph below:

Note that:

- “SP” is Smartphones Game (or Mobile Game)

- “ON” is online, streaming game

- “OFF” is offline, on-demand game

Reasons for the Top Figures

Mobile Gaming Culture:

- Large audience group: Mobile games are widely embraced and deeply integrated into Japanese society. A Statista research in 2022 shows that among people who play games at least once per month, people from all age groups start to play mobile games everyday.

- Social Group Value: Players not only enjoy the entertainment aspect but also value the social aspects of gaming, such as competing with friends and participating in virtual communities. By investing a certain amount or successfully drawing out a “lucky ticket”, players can get the chance to join offline events with their favorite characters. This strong gaming culture fosters a willingness to invest in in-app purchases to gain a competitive edge or unlock exclusive content.

- Gacha mechanism: Mobile games in Japan are generally free-to-play but monetized via the ‘gacha’ mechanism, which is in-app purchases for raffle. Gacha games make up almost all of Japan’s popular mobile game titles, becoming a valuable monetization strategy.

Quality and Innovation

Japanese consumers have a deep appreciation for quality, craftsmanship, and unique experiences. Their attention to detail, captivating visuals, and immersive gameplay attract a loyal fan base willing to invest in the offerings. This cultural inclination translates into a higher willingness to spend on in-app purchases and mobile games. The Japanese market demands excellence, and developers rise to the occasion, creating games that resonate deeply with users and drive higher ARPPU.

Cultural Preferences

- Collecting Hobby: The concept of collecting and completing sets is deeply ingrained in Japanese culture, with popular examples such as Pokémon cards, Gundam models, and various anime merchandise. This culture translates into the mobile gaming sphere, where players are motivated to collect in-game items, characters, and rare virtual goods. The desire to complete collections or obtain exclusive items drives Japanese gamers to invest in in-app purchases and microtransactions to enhance their gaming experience

- Developer Support: Purchasing in-app items or game-related content can also be seen as a form of supporting the developers or expressing appreciation for the entertainment they provide

Conclusion

In conclusion, Japan’s remarkable ARPPU in the mobile app and gaming industry can be attributed to their users’ willingness to spend more on in-app purchases and games. Japan’s unique cultural background and history of collecting toys and cards likely play a role in shaping their spending habits. By understanding and leveraging these factors, developers and gaming companies can tap into the lucrative Japanese market and create tailored experiences that resonate with Japanese users.